State Farm Car Insurance - Your Road To Peace Of Mind

Thinking about your car's protection can feel like a big deal, can't it? We all want to feel safe when we're out on the road, knowing that if something unexpected happens, we've got a reliable helper by our side. Finding the right kind of coverage for your vehicle, one that truly fits what you need and how you live, is a pretty important step for anyone who drives. It's about more than just a policy; it's about feeling secure and having fewer worries as you go about your day, which is something we all look for.

For many folks, their car is a really big part of their daily routine, whether it's for getting to work, picking up groceries, or just taking a weekend trip. Because our vehicles are so central to our lives, it makes sense to give some thought to how we keep them protected. You want options that speak to your specific situation, maybe you have a new driver in the house, or perhaps you've recently gotten an electric car, so you're looking for something a bit different. It’s about making sure your ride is looked after, no matter what kind it is or who is behind the wheel, you know?

When you start looking around, you'll find there are many choices out there for vehicle protection. It can seem like a lot to sort through, but the good news is that some providers have been doing this for a very long time, helping people just like you figure out what works best. They’ve built up a lot of know-how over the years, and that experience means they often have a wide array of options ready for different kinds of drivers and different types of cars. This kind of background can really make a difference when you're picking out something as important as your car's coverage, honestly.

Table of Contents

- What Choices Do You Get with State Farm Car Insurance?

- Making Sense of Your Car Protection

- How Can You Make Managing Your State Farm Car Insurance Easier?

- Common Kinds of Vehicle Protection

- Is State Farm Car Insurance a Good Fit for Your Area?

- What is Comprehensive Vehicle Protection?

- Are There Ways to Save on Your State Farm Car Insurance?

- Getting in Touch and Paying Your State Farm Car Insurance Bill

What Choices Do You Get with State Farm Car Insurance?

A Century of Helping with State Farm Car Insurance

When you think about getting coverage for your vehicle, you'll find State Farm has a good number of options. They've been around for a very long time, over a century, actually, helping people with their driving needs. This means they have lots of ways to cover your ride, whether it's for someone just starting to drive, or for those with newer electric or hybrid vehicles, and so much more. It's pretty clear they have a lot of experience in this area, so you can expect a variety of ways to keep your car safe.

This long history means they’ve seen a lot of changes in how people drive and what kind of cars are on the road. So, they've had plenty of time to figure out what works best for different folks. For instance, if you have a young person in your household who just got their license, they have specific kinds of vehicle protection that can fit their situation. Or, if you’ve recently gotten one of those quiet, new electric cars, they have ways to cover those too, which is kind of neat. It’s all about having choices that make sense for your particular life, you know?

It’s not just about covering the new stuff, either. Their century of experience also means they've helped generations of drivers with all sorts of regular cars and trucks. So, if you're just looking for standard protection for your everyday vehicle, they have plenty of those options available too. Plus, if you decide to move your policy over to them, you might just keep more money in your pocket, which is pretty neat. It really is worth looking into what they offer, especially with all that background, so.

Making Sense of Your Car Protection

Understanding Your State Farm Car Insurance Choices

It's a good idea to understand what vehicle coverage really means, presented in a way that just makes sense. You can look at the various kinds of protection available for your car and get a personal estimate for comprehensive coverage right away. It's about getting a clear picture of what you're paying for and what it does for you. Nobody wants to feel confused about something as important as their vehicle's safety net, so they try to keep it straightforward.

When you're exploring the different types of protection, it can sometimes feel like you're reading a foreign language. But the goal here is to break it down into easy-to-understand pieces. For example, what does "full coverage" actually mean for your specific situation? It's not a one-size-fits-all thing, so getting a quote that's just for you helps clear things up. This way, you can see exactly how different options might affect what you pay and what kind of help you'd get if something were to happen, which is very helpful.

Simply pick the kind of protection you're interested in, and you can get an estimate on what your rate would be from State Farm. It’s pretty simple to do, too. You don't have to guess or wonder; you can get a number that's specific to your vehicle and your driving habits. This helps you compare and decide without any extra fuss. It’s about giving you the information you need, in a way that’s easy to get, so you can feel good about your choices, you know?

Beyond just vehicle protection, you can often make things easier for yourself, save some cash, and avoid a lot of fuss by bundling different types of policies together. Think about it: if you have coverage for your home and your car, putting them together with the same provider can sometimes mean a better deal overall. It’s a way to simplify your life and potentially save some money at the same time, which is always a good thing. This combining of policies is something many people find helpful, honestly.

How Can You Make Managing Your State Farm Car Insurance Easier?

Handling Your State Farm Car Insurance on Your Schedule

They really try to make handling your policies simple, even when life gets pretty hectic. You can set up an online account and take care of your coverage needs whenever you want, no matter where you happen to be. This means if you suddenly remember something about your policy late at night, or if you're away from home, you can still access your information and make changes. It’s about fitting into your busy life, rather than making you fit into theirs, so.

Having an online account means you’re in control. You don’t have to wait for business hours or try to find a moment during your workday to call someone. Whether it’s checking your policy details, looking at your payment history, or even making a quick update, it’s all right there at your fingertips. This kind of accessibility is something many people appreciate these days, especially with how busy everyone seems to be. It’s just a little bit of convenience that makes a big difference, you know?

And now, it's all accessible with just one way to get in, which is pretty convenient. This single login means less remembering different usernames and passwords, making the whole process even smoother. Imagine not having to scramble to find your login details every time you need to check something; it just makes life a little less complicated. This ease of access is something they've worked on to help customers manage their State Farm car insurance and other policies without any extra bother.

Common Kinds of Vehicle Protection

Everyday State Farm Car Insurance Coverages

A lot of vehicle policies come with ways to cover things like when your car bumps into something, or gets damaged by other events, or if you're responsible for someone else's trouble, or even if someone without enough coverage causes an issue. These are some of the more common types of protection you’ll typically see mentioned. It's good to know what each one generally covers, so you can pick what feels right for you and your driving habits, too it's almost.

For instance, "collision" coverage helps with the costs if your car hits another car or something else, like a tree or a pole. It’s about getting your own vehicle fixed up after an accident where you’re involved in a crash. Then there's "comprehensive" coverage, which is for things that aren't a collision, such as if your car gets stolen, or if it's damaged by a storm, or even if a deer runs into it. These are the kinds of things that can happen even if you're driving carefully, so having this kind of protection is often a good idea.

Then you have "liability" coverage, which is a big one. This helps if you're at fault in an accident and cause harm to someone else or their property. It’s there to help pay for their medical bills or to fix their car, so you don't have to pay for it all out of your own pocket. And sometimes, you might run into a driver who doesn't have any protection, or not enough, which is where "uninsured or underinsured motorist" coverage comes in handy. It’s there to help you if that happens, which can be a real relief, honestly.

These are just some of the main components you'll find in many State Farm car insurance plans. Each piece serves a different purpose, but together, they create a safety net for you and your vehicle. Understanding these basics can help you feel more confident about the choices you make for your car's protection. It's about building a plan that covers the various possibilities you might encounter on the road, so you're ready for whatever comes your way, you know?

Is State Farm Car Insurance a Good Fit for Your Area?

Finding Good Value with State Farm Car Insurance Locally

Picking State Farm means getting solid car protection right where you live, and it also means getting a good deal for your money. It’s about finding that balance between good coverage and a price that feels fair. You want a provider that understands the local driving conditions and needs, and can offer something that truly works for people in your community, which is pretty important.

When you're looking for vehicle protection, it’s not just about the name; it's about what they can actually do for you in your specific location. State Farm has agents in many different places, so there's a good chance there's someone nearby who knows the local roads and the particular situations drivers face in your area. This local connection can be really helpful when you have questions or need assistance, so you're not just talking to a call center far away.

You can get an estimate for your vehicle coverage online, or you could stop by a State Farm representative nearby to hear about ways to save. It’s nice to have both options, isn't it? If you prefer to do things quickly from your computer, that’s there. But if you like talking to a person, asking questions face-to-face, and getting advice that feels more personal, then visiting an agent is a great choice. It’s about getting the information you need in the way that suits you best, which is very helpful.

What is Comprehensive Vehicle Protection?

Beyond Crashes - State Farm Car Insurance for the Unexpected

Full vehicle protection, the kind that helps with bigger issues, can assist with the costs to fix up or get a new car if it's taken or hurt by things that aren't a typical crash. This type of coverage is often called "comprehensive," and it’s for those moments when life throws something unexpected your way that doesn't involve another vehicle hitting yours. It’s about protecting your car from a wider range of possibilities, you know?

Think about scenarios like a tree branch falling on your car during a storm, or if someone decides to break into your vehicle and cause damage. Comprehensive coverage steps in for these kinds of events. It also covers things like fire, theft, vandalism, or even if you hit an animal while driving. These are all things that can happen even if you’re being a very careful driver, so having this kind of protection can bring a lot of peace of mind, actually.

It's distinct from collision coverage, which, as we talked about, is for when your car collides with something. Comprehensive is for those other, sometimes stranger, things that can go wrong. It’s an important part of a well-rounded vehicle protection plan for many people, especially if you live in an area where certain natural events are common, or if you're concerned about theft. It really adds another layer of security for your vehicle, so.

Are There Ways to Save on Your State Farm Car Insurance?

Finding Price Breaks with State Farm Car Insurance

If you're a State Farm customer, there's a chance you could qualify for several kinds of price breaks and ways to keep your money, which is rather nice. Everyone likes to save a little cash, especially on something like vehicle protection. These price reductions are often given for different reasons, like how you drive or what kind of safety features your car has. It’s worth looking into what might apply to you, you know?

For instance, being a careful driver might mean you pay less. Many providers, including State Farm, offer discounts for drivers who maintain a good record and avoid accidents. This makes sense, as less risk often means lower costs. Other ways to save could involve having certain safety equipment in your car, or perhaps if you take a defensive driving course. These little things can really add up over time, which is pretty cool.

There are also often price breaks for things like having multiple policies with them, like your home and car coverage, as we mentioned earlier. Or maybe for students who get good grades, or for having certain security systems in your vehicle. Just remember, any price reductions and whether you can get them might depend on where you are and what the rules are for qualifying. It’s always a good idea to ask about all the possibilities when you’re getting a quote or reviewing your current plan, so you don't miss out on any savings, honestly.

Getting in Touch and Paying Your State Farm Car Insurance Bill

Simple Ways to Manage Your State Farm Car Insurance Payments and Questions

When it's time to take care of your bill, you can use a quick pay option without needing to sign in, or you can sign in with your usual details to set up automatic payments, look at old statements, and do a bunch of other things. They try to make it as simple as possible to handle your payments, whether you like to do it on the fly or set it and forget it. This flexibility is something many people appreciate, especially with busy schedules, too it's almost.

The "guest pay" option is super handy if you just need to make a quick payment and don't want to log into your full account. But if you prefer to have more control and see all your policy details, logging in gives you that. You can schedule payments so you never miss one, review past bills to keep track of your spending, and generally manage your account at your own pace. It’s about giving you choices for how you interact with your State Farm car insurance, which is very thoughtful.

If you're in Iowa, you can find a local representative and get an estimate at no cost today. No matter what kind of protection you're looking for in Iowa, State Farm is there to help make sure things go smoothly. This local presence means you have someone nearby who can answer your questions and help you figure out what you need. It's a personal touch that can be really comforting when you're making important decisions about your coverage, you know?

You can locate a State Farm representative close by to get coverage for your house, your life, your car, and even help with money matters in your community. This is where you begin to find a State Farm agent in your neighborhood. To get more details about vehicle protection where you live, simply find a State Farm agent. You can get in touch with State Farm using their online tools, by calling them, sending an email, or even by regular mail. They offer many ways to connect, so you can pick what works best for you when you have questions about your State Farm car insurance or anything else.

Ultimately, choosing a vehicle protection provider is about finding someone who makes things clear, offers good options, and is easy to deal with. State Farm, with its long history and many ways to help, aims to give you just that. From helping new drivers get started, to covering modern electric cars, and offering simple ways to manage your account and pay your bills, they work to make your life

File:Map of USA showing state names.png

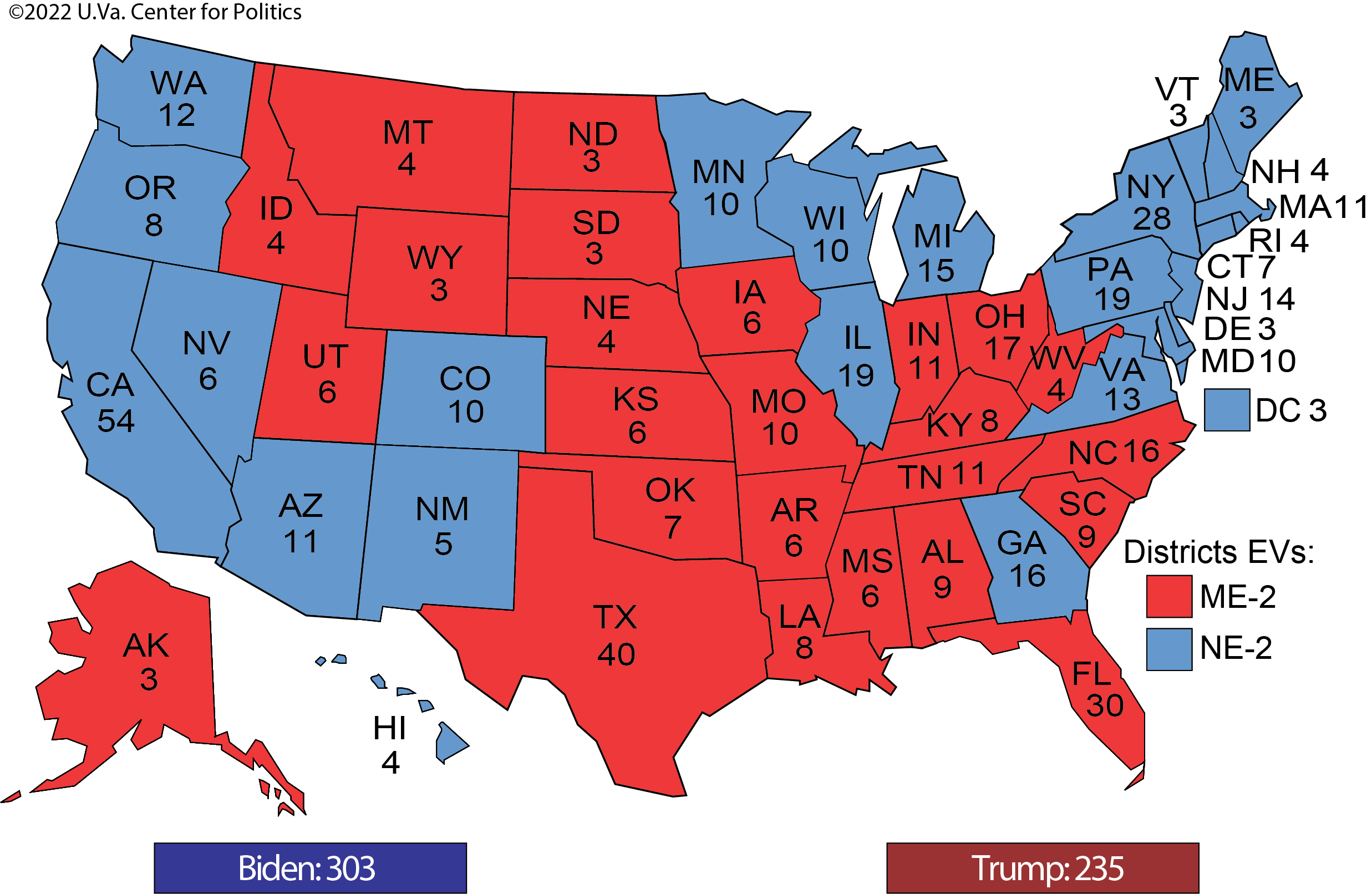

Notes on the State of Politics: March 1, 2023 – Sabato's Crystal Ball

Washington Counties Map | Mappr