Monarch Money

Taking charge of your personal finances can feel like a big job, but it doesn't have to be, you know. Lots of folks are looking for a straightforward way to keep tabs on their money, and a fresh approach to how they handle their daily spending and future plans. This is where a modern way of looking at your funds comes into play, offering a clearer path to feeling more at ease with everything.

For many, figuring out where every dollar goes, or how their savings are doing, can be a bit of a puzzle. There's often a wish for something that just makes it all click, something that helps bring all those separate money bits into one easy-to-see spot. It's about getting a good handle on things, really, so you can make choices that feel right for your own situation. That, in some respects, is what people are hoping for.

This article is here to walk you through how one particular tool aims to make all of that simpler. We'll look at how it helps you keep track of your money, how it assists with making good spending choices, and even how it supports you in planning for what's ahead. It's about seeing your whole money picture more clearly, you see, and getting a better sense of control over your financial life.

Table of Contents

- Monarch Money - A Fresh Approach to Personal Finances

- Handling Your Everyday Money with Monarch Money

- How Does Monarch Money Help You Spend Wisely with Monarch Money?

- Looking Ahead - Your Future with Monarch Money

- Can Monarch Money Really Help You Plan for What's Ahead?

- Why Does Money Cause So Much Worry, and How Can Monarch Money Help?

- Working Together - Bringing Others into Your Monarch Money Picture

- What Makes Monarch Money Stand Out for Budgeting in 2024?

Monarch Money - A Fresh Approach to Personal Finances

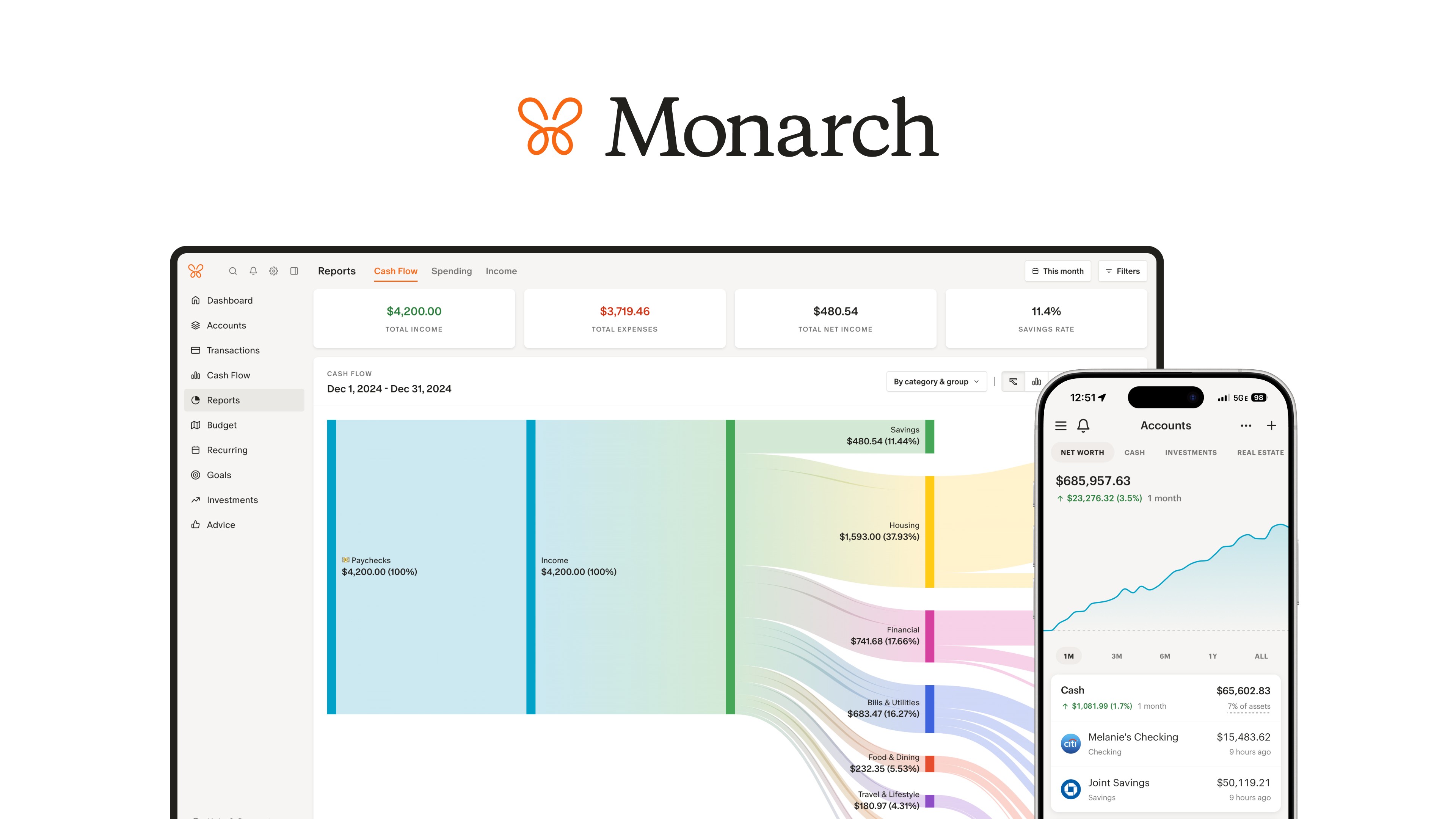

Thinking about how we deal with our money, it's pretty clear that the old ways don't always fit with how we live now. We need something that feels current, something that keeps up with how quickly things move. A good tool for managing your personal funds should, you know, feel like it's built for today's world, not yesterday's. It should offer a simple way to bring all your financial details together in one place, giving you a clear view of where you stand.

This idea of a modern approach means making things straightforward. It means you shouldn't have to jump through hoops just to see your bank balance or check on your credit card. The aim is to give you a complete picture without a lot of fuss. It’s about having a calm, clear view of your money situation, so you can feel more settled about it all, you know, rather than feeling scattered.

When everything is laid out plainly, it's easier to spot what's going on with your funds. This kind of clarity helps you make better choices, whether it's about what you spend, what you save, or what you put aside for later. It truly is about making money matters less of a headache and more of a helpful tool for your daily life, in a way, which is what many people really want.

Handling Your Everyday Money with Monarch Money

Keeping track of all your accounts can sometimes feel like a bit of a chore, can't it? You might have money in one place, a credit card in another, and maybe some savings somewhere else entirely. It’s easy to lose sight of the full picture when everything is spread out. A good system, however, brings all these pieces together, making it simple to see everything in one go. This kind of clear view can make a big difference in how you feel about your money, you know, making it less of a mystery.

With a tool like Monarch Money, the idea is to make this process truly easy. Imagine logging in and seeing all your bank accounts, your credit cards, and even any loans you might have, all listed in one spot. This means you don't have to jump from one website to another just to get a sense of your overall financial standing. It’s about saving you time and effort, basically, which is pretty handy.

This ease of seeing everything together helps you stay on top of your daily spending and income. You can quickly check if a bill has been paid, or if a deposit has come through. It takes away some of the guesswork, giving you a quiet confidence about your money. It’s a very simple way to feel more in control, and that, you might find, is a really good feeling to have.

How Does Monarch Money Help You Spend Wisely with Monarch Money?

Thinking about how you spend your money, do you ever wish you had a clearer idea of where it all goes? It's one thing to track what comes in and out, but another to really make sure your spending matches what you want for your life. That, you know, is where getting a bit smarter about your habits can really help. It’s not about stopping you from buying things you enjoy, but about making sure your money serves your broader aims.

Monarch Money offers ways to help you fine-tune your spending habits. It helps you see where your money is actually going, category by category. This means you can easily spot if you’re spending a little too much on eating out, or if your subscriptions are adding up more than you realized. This kind of insight allows you to make small adjustments that can add up to big changes over time, more or less, which is pretty cool.

When you have a good grasp of your spending patterns, you can decide what changes you want to make. Maybe you want to put more money towards a specific goal, or perhaps you just want to feel more relaxed about your daily purchases. The goal is to help you make choices that feel good and that move you closer to what you want. It truly is about giving you the ability to guide your money, rather than letting it guide you, in some respects.

Looking Ahead - Your Future with Monarch Money

Monarch's Refreshed Look & Product Updates | Monarch Money

Monarch Money Review (2023): Modern Money Management

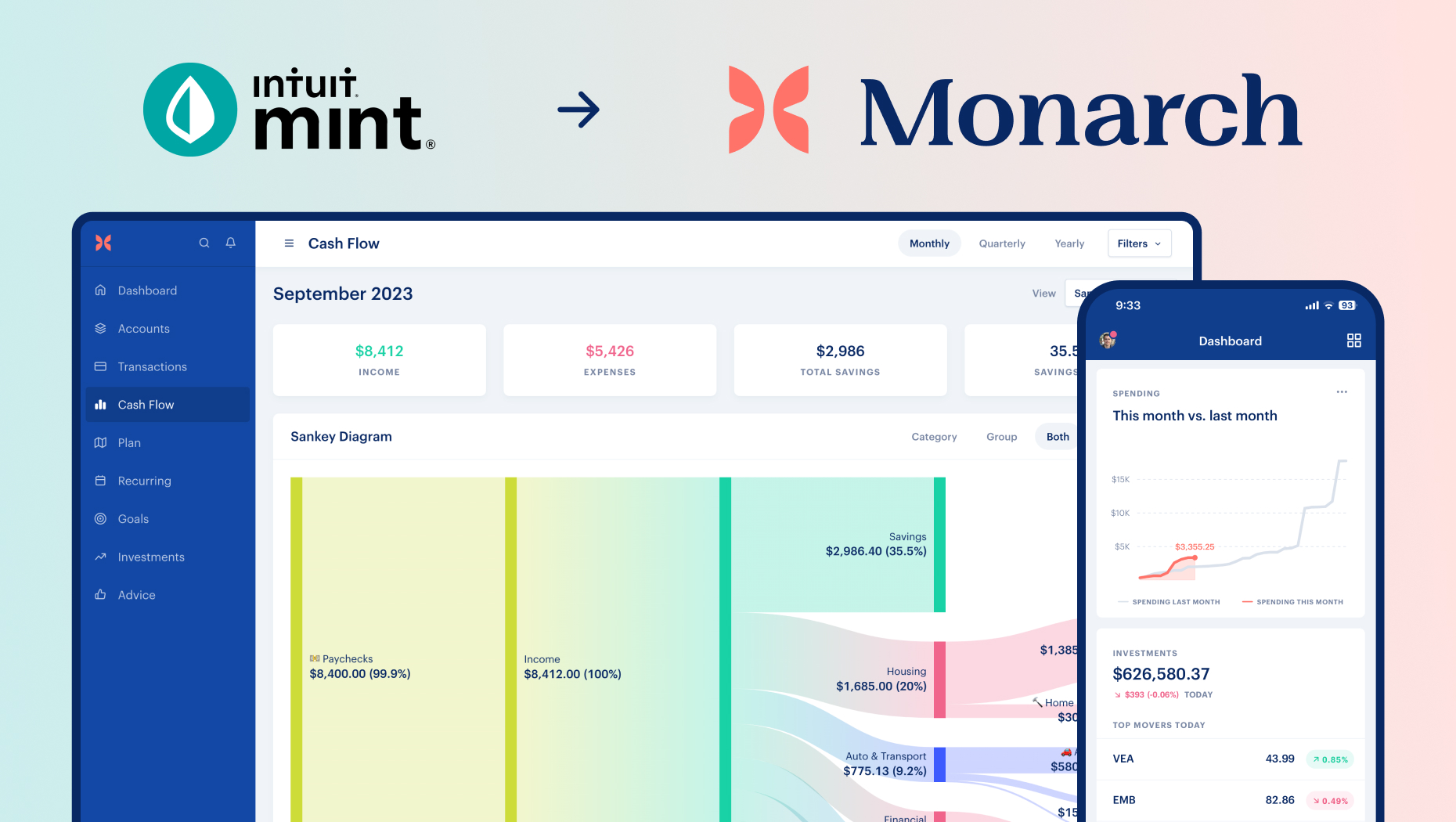

When is Mint shutting down? | Monarch Money