Addition Financial - Your Money Partner For A Brighter Future

Thinking about your money can feel like a lot, can't it? Well, imagine having a friendly guide right there with you, helping you sort things out and feel good about your financial life. That's pretty much what Addition Financial is all about, offering ways to make handling your money a little bit easier and a lot more helpful for everyone. They really aim to make personalized money insights something everyone can get their hands on, so you know, you can feel more in charge.

It's kind of exciting, too, because they're always looking for ways to make things better. For instance, there's news about Envision Credit Union joining up with Addition Financial Credit Union, and that's actually going to mean a big step up for your banking experience. It’s all about making sure you get better service and more useful options, which is pretty cool if you ask me.

So, whether you're just starting to think about saving, or you're wondering how to get a hold of someone to ask a question, this place wants to be there for you. They’re a credit union, which means they’re set up to help their members really get ahead with their money, and they’re pretty passionate about it, you know, helping people with their personal finances.

Table of Contents

- Making Money Work for You - The Addition Financial Way

- A Bigger Team for Better Banking with Addition Financial

- Where Can Your Savings Take You with Addition Financial?

- Getting in Touch with Addition Financial

- What Makes Addition Financial Different?

- Your Money, Your Way - Digital Tools from Addition Financial

- Special Offers and Ways to Borrow from Addition Financial

- A Partner for Your Whole Money Life

Making Money Work for You - The Addition Financial Way

Having a good handle on your money matters can feel like a big weight off your shoulders, right? Addition Financial is really focused on what they call "holistic financial wellness." What that means, basically, is looking at your whole money picture, not just bits and pieces. They want to make sure everyone, especially folks through their jobs, can get helpful, personal money advice. It's about giving you the clear ideas you need to feel more settled about your financial situation, which is actually quite reassuring.

They see money well-being as something that should be open to all, and they work to make sure their insights are easy to get. It’s not about using big, confusing words, but rather giving you straightforward ways to see how your money can serve you better. So, if you're an employee, this kind of help can really make a difference in how you approach your daily money decisions. It’s a bit like having a helpful friend explain things, you know, in a way that makes sense.

Their goal is to support people in taking steps to feel more in charge of their financial existence. They’re pretty keen on helping individuals with their personal finances, and that enthusiasm really shows in how they set things up. It’s about more than just numbers; it's about helping you feel calm and capable with your cash, which is what we all want, isn't it?

A Bigger Team for Better Banking with Addition Financial

There's some pretty exciting news that means good things for folks who bank with them. Envision Credit Union and Addition Financial Credit Union are joining forces, which is a big deal. When two good groups like this come together, it typically means even better service and more useful options for you, the customer. It's all about making your banking experience a step up from what it was before, really.

This team-up is set to make your financial interactions smoother and more helpful. They're working to upgrade everything, from the products they offer to the way you interact with them. It’s a bit like getting a new, improved version of something you already like, so, it's pretty neat. This kind of collaboration often brings fresh ideas and a wider range of services, which can only be a good thing for everyone involved.

The whole point of this coming together is to give you a more polished and capable banking experience. They’re looking at all the ways they can make things better for you, and that includes the various products and services they have on offer. So, you can expect some positive changes that are aimed at making your money life simpler and more effective, you know, in a practical sense.

Where Can Your Savings Take You with Addition Financial?

Have you ever stopped to think about what you really want your saved money to do for you? It's a pretty important question, actually. Addition Financial wants to help you figure out just that. Whether you're putting money aside for a new home, a trip, or just a more secure tomorrow, they’re there to help you make those plans a reality. They understand that everyone has different hopes for their money, and they want to support those individual aspirations.

They offer ways to help your money grow, like earning a bit extra on your savings. This can help you get to your goals a little faster, which is pretty encouraging. It’s not just about keeping your money safe; it’s about making it work harder for you, so it can help you reach those bigger personal aims. They really want to know what your savings dreams are, because that helps them show you how they can assist.

So, whether your aim is big or small, they’re ready to help you map out the path to get there. They provide the tools and the support to help your savings become more than just numbers in an account; they become the means to achieve your personal milestones. It’s about making your money dreams feel a lot more within reach, and that’s a good feeling, you know, to have that kind of support.

Getting in Touch with Addition Financial

Sometimes you just need to talk to someone, don't you? Finding out how to get in touch with Addition Financial is pretty straightforward. You can reach them in a few different ways, whether that's by phone, sending a fax, writing a letter through the mail, or using a secure message option. They want to make sure it’s easy for you to connect with them whenever you have a question or need some help, which is fairly thoughtful.

If you're looking for personal assistance, you can certainly reach the credit union directly. They have people ready to help you with your specific needs, so you don't feel like you're just talking to a machine. This kind of direct contact can make a big difference when you have something important to discuss about your money. It's good to know there's a real person there to listen, isn't it?

For those who might be wondering about a specific spot, like how to contact Addition Financial Credit Union's customer service in Lake Mary, Florida, they make that information available too. They’re set up to provide assistance for their members, no matter where they are or what kind of question they have. They really are there to help you, and that's a key part of what they do, you know, being available.

What Makes Addition Financial Different?

Addition Financial is a credit union, and that actually means something a little different from a regular bank. Credit unions are set up to help their members achieve financial success, and that's their main goal. They're not focused on making profits for outside shareholders; instead, any money they make typically goes back to their members through better rates or lower fees. This can be a pretty big advantage for you, really.

They are quite passionate about helping individuals with their personal finances. This isn't just a job for them; it's a genuine commitment to seeing people do well with their money. They really put their members first, which is a pretty good feeling when you're choosing a place to keep your money. It’s about building a connection and helping you reach your own money goals, you know, in a supportive way.

This group has been around for a good while, too. Established way back in 1937, Addition Financial Credit Union has its main office in Lake Mary, Florida. You can find them at 1000 Primera Blvd, Lake Mary, FL 32746. Knowing their history and where they come from can give you a bit of confidence in their long-standing commitment to their community and members. They’ve been helping people for a very long time, after all.

Your Money, Your Way - Digital Tools from Addition Financial

In today's busy world, managing your money often means doing it online or through an app. Addition Financial makes it easy to register, set up, and make your digital bank account your own. They're considered a good financial institution, and they want you to feel comfortable using their online tools. You can customize things to fit how you like to handle your money, which is pretty convenient.

They offer different kinds of checking accounts, so you can pick one that fits your personal banking needs and what you’re trying to achieve with your money. Not everyone uses their checking account the same way, so having options is really helpful. You can compare what each account offers to see which one makes the most sense for you, which is a sensible approach, you know, to finding the right fit.

And there are some nice perks that come with banking with Addition Financial Credit Union. You can earn a bit extra on your money, get a break on loan rates, and use ATMs without paying extra fees, among other things. These benefits can really add up and make your banking experience more rewarding. It’s about getting more value from where you keep your money, and that’s always a plus, isn't it?

This organization is known for how they approach things – they think things through carefully and also show a lot of care for their members. They really try to be thoughtful in how they help you, which makes a big difference. It's not just about the transactions; it's about the people behind them, and how they make you feel about your money matters.

Special Offers and Ways to Borrow from Addition Financial

If you're thinking about getting a new or used car, Addition Financial offers auto loans with good rates. They also have flexible payment plans and some special insurance choices, which can make getting a vehicle a bit easier. It’s about giving you options that work for your situation, so you can drive away with confidence. They want to make sure you get a deal that feels right for you, which is pretty considerate.

Beyond that, they also make it easy to do a lot of your daily money tasks online. You can figure out how to register for services, move money between accounts, pay your bills, and get to your financial details whenever you need to. This means you can handle a lot of your money stuff from wherever you are, which is very helpful for busy lives. It’s all about making things accessible, you know, for your convenience.

They’re here to help you keep your financial journey smooth and simple. If you need support, they have tools ready for quick access. This means you can find what you need without a lot of fuss, which is pretty important when you’re dealing with money matters. They want to make sure you feel supported every step of the way, which is a good sign of their commitment.

And there are some appealing ways to get started with them, too. You could open a checking account and potentially get up to $200 if you meet certain requirements within 90 days. That’s a nice little bonus, isn't it? You can also apply for a loan or a credit card and start enjoying the various benefits that Addition Financial offers. They make it pretty inviting to become a part of their group.

A Partner for Your Whole Money Life

Addition Financial Credit Union was voted Newsweek's Best Credit Union for 2025, which is a pretty big honor. This means they're recognized as a top local financial institution for your banking needs. It speaks to the quality of their service and how much their members value them. It’s a good sign that they’re doing things well, you know, getting that kind of recognition.

As of 2024, they proudly help people in 24 counties across Florida. They provide affordable money services, which include different kinds of checking and savings accounts, credit cards, and loans. They really work to make sure their services are within reach for lots of people. Their goal is to serve a wide community, and they’re doing a good job of that, it seems.

They also have a good number of places you can visit in person, with 26 different branch locations. For example, the Winter Garden branch is located in Winter Garden, Florida, at 950 9th Street. Having physical locations means you can always stop by if you prefer talking to someone face-to-face or need to handle something in person. It’s nice to have that option, isn't it?

Addition Financial’s main aim is to help their members do well with their money. They are truly there to help you. If you need to get in touch with a specific part of their organization, or a particular branch, or Addition Financial generally, they make it clear that they’re ready to assist. Their core belief is in helping you succeed financially, and they act on that belief every day.

They really want to upgrade your banking experience, from the products they offer to how easy it is to use them. They invite you to start banking with Addition Financial today. They’re excited for you to count them in as your financial helpers. No matter where you are in your life, or what your money goals might be, they’re ready for you to include them as your financial partner. They offer a good variety of checking accounts, too, for all sorts of different situations and needs. It's clear they want to be a supportive part of your money story.

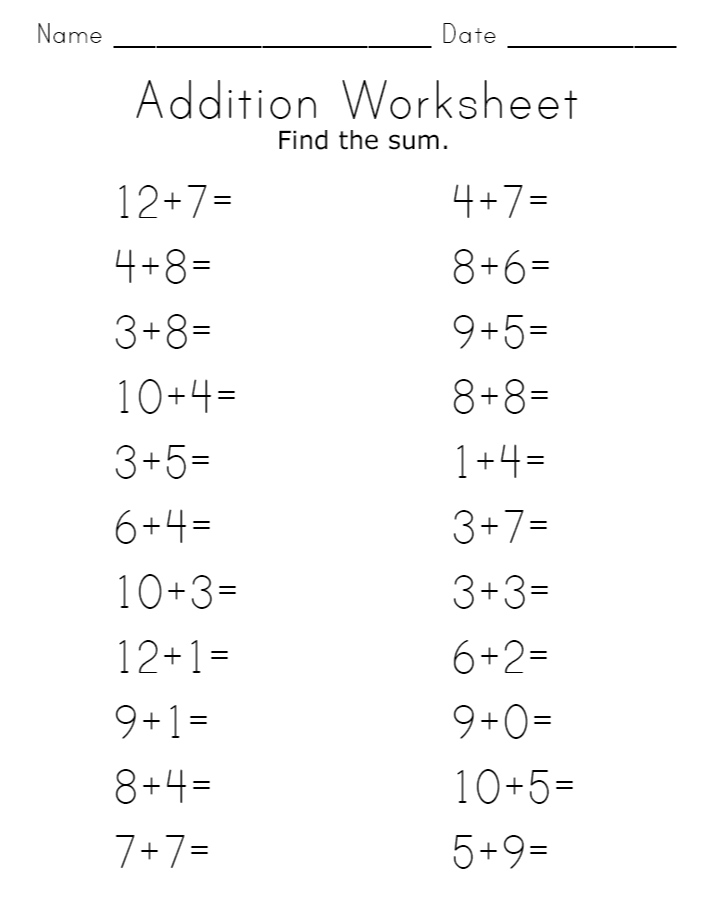

Addition Worksheet - Worksheet Digital | #1 Teacher-Made Resources

Free Printable Resources For Teachers Parents And Children: Free

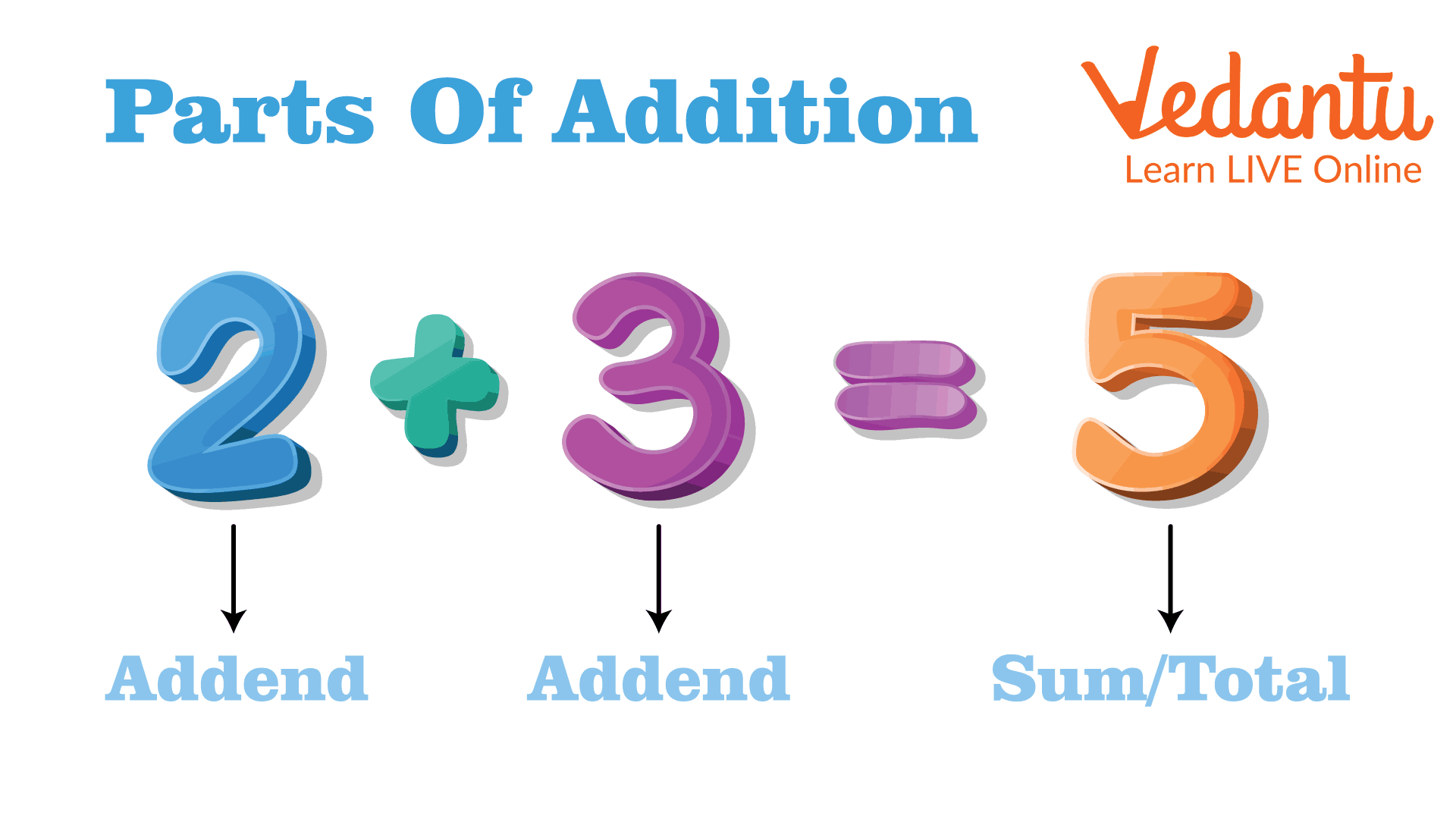

2-Digit Addition For Class 1 | Learn and Solve Questions